Quicken is actually an internet personal financing government equipment that can easily be regularly song transactions and you will perform lender, broker, credit card and you may mortgage profile, along with figuratively speaking. Quicken lets profiles to help make a funds, carry out expense, and construct coupons specifications. And then make a funds is the first step from inside the managing college loans and you can paying personal debt eventually.

Devices to own Dealing with Education loan Obligations that have Quicken

The loan Calculator calculates monthly financing payments and you can reveals the brand new fee plan. it may determine the borrowed funds amount. Which device are often used to determine education loan repayments lower than Standard Fees and you will Expanded Installment.

The debt Prevention Coordinator try a budgeting product which will help you only pay off debt sooner and relieve the total focus your shell out. It includes you having an idea so you can get of personal debt, based on information regarding all of your loans inside the Quicken, together with your figuratively speaking. They executes the newest avalanche opportinity for paying loans quicker. New avalanche strategy makes the requisite costs on the any financing and additional money on the financing into the high interest rate. The debt Cures Planner shows new effect of them more payments to your loan harmony, total appeal reduced in addition to go out the newest fund was paid back.

Quicken provides a free of charge credit rating, up-to-date quarterly. The financing rating lies in the latest VantageScore step three.0 having fun with Equifax analysis. It credit rating is not the just like the credit results used by loan providers while making borrowing from the bank conclusion. The financing score rates their efficiency since worst, pretty good, a good and you can advanced with each other multiple dimensions, including credit card incorporate, percentage history, period of borrowing from the bank, full accounts, borrowing from the bank questions and you may derogatory scratching. This will help you choose how to change your fico scores.

Dealing with College loans Yourself

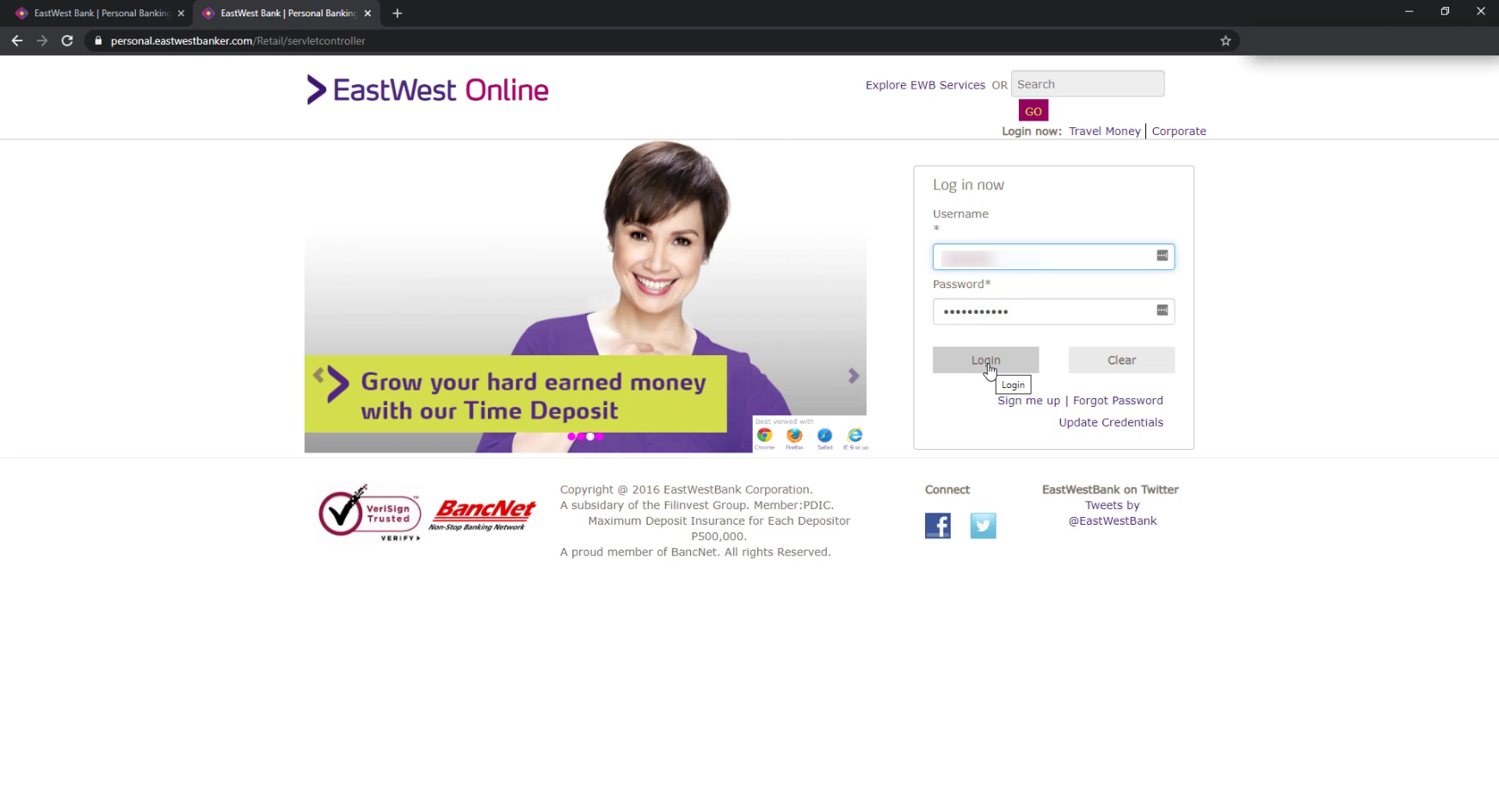

You can include your college loans to Quicken manually, utilising the Incorporate a new Mortgage… eating plan option. This selection option lets you indicate a loan since a student Financing, because the found contained in this display picture.

not, student loan accounts when you look at the Quicken dont already deal with the fresh finished payment and you can money-inspired fees preparations, just simple repayment and you will extended installment https://paydayloanalabama.com/avon/. The mortgage payments not as much as finished payment and you will earnings-motivated fees will need to be added by hand.

Quicken plus will not tune the amount of qualifying money for borrowers who’re performing on public-service mortgage forgiveness.

Linking Quicken in order to Education loan Loan providers

It may be you can easily to help you hook up Quicken so you can federal and personal figuratively speaking, based on your unique financing servicer. It listing of loan servicers was extracted from new FIDIR document in the Quicken configuration. Addition from a loan provider in this document cannot indicate the financial already supporting purchase obtain otherwise that the lender helps deal obtain for student loan levels as opposed to most other membership systems. The only way to do not forget would be to arrange this new education loan for starters Action Modify during the Quicken. You may also is actually verifying for the lender otherwise financing servicer.

No matter if financing servicer supports linking with Quicken, it might let you know only the borrower’s overall student loan obligations, maybe not the individual finance, whether or not for every single financing have yet another interest rate.

Such servicers off Federal Lead Loans are part of the latest FIDIR file. None of these mortgage servicers, not, offer details about Quicken consolidation to their websites.

- Cornerstone Education loan Solution

- FedLoan Upkeep (PHEAA)

- Granite Condition Government & Res (GSMR)

- Great Ponds Ed Mortgage Services

- EdFinancial Qualities

- Navient Funds

- Oklahoma Student loan Expert

- MOHELA Mortgage

Another lenders and you will loan servicers are not within the Quicken FIDIR file, so that they most likely dont promote linking having Quicken.

When you have any problems otherwise concerns, Quicken also provides free mobile phone and you may cam direction. More resources for Quicken or join, head to their website.

Bottom line

Quicken can help you get the earnings structured and create good technique for settling student loan financial obligation and you will getting their most other economic goals. You can attempt Quicken for a 30-day risk-free trial.